Report Overview

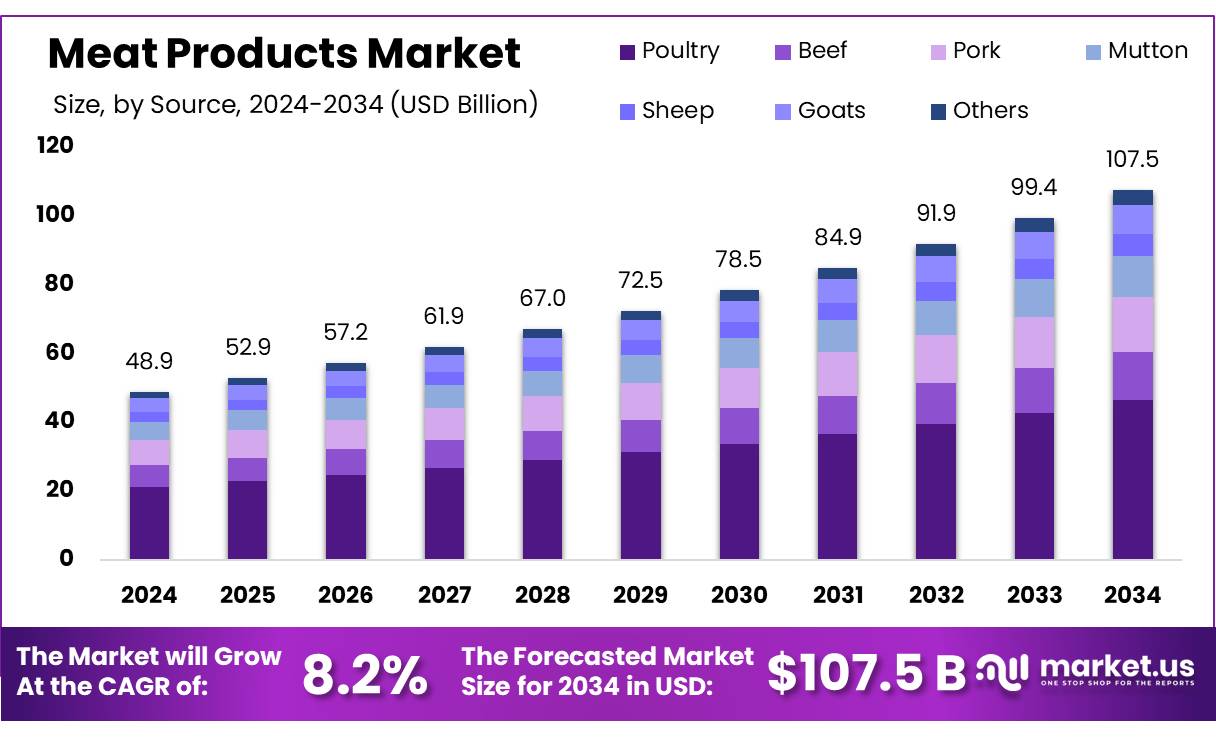

The Global Meat Products Market size is expected to be worth around USD 107.5 Billion by 2034, from USD 48.9 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

The meat products concentrates industry plays a pivotal role in the broader food processing sector, delivering highly nutritious, flavor-enhancing, and preservative components that are essential in processed meat production. These concentrates, derived primarily from animal proteins, are utilized to improve the texture, taste, and shelf life of a variety of meat products such as sausages, deli meats, and ready-to-eat meals. The global demand for meat products concentrates is closely tied to the increasing consumption of processed and convenience foods driven by evolving consumer lifestyles, urbanization, and rising disposable incomes.

The meat products concentrates has witnessed steady growth due to intensified meat processing activities and the expanding food and beverage industry. According to the United States Department of Agriculture (USDA), the U.S. meat processing sector alone generated revenues exceeding USD 250 billion in 2023, reflecting a robust demand for functional ingredients like meat protein concentrates to meet consumer preferences for quality and safety.

Additionally, the Food and Agriculture Organization of the United Nations (FAO) reports that global meat production reached approximately 340 million tonnes in 2024, further underpinning the significance of concentrates in the processing pipeline to optimize meat utilization and reduce wastage.

![]()

Several driving factors are propelling the growth of this sector. Increasing health awareness has led consumers to seek protein-rich diets, positioning meat concentrates as a vital ingredient in fortified foods and nutraceuticals. The Food and Agriculture Organization of the United Nations (FAO) reports that global per capita meat consumption reached 43.2 kilograms in 2022, with projections estimating a rise to 47.6 kilograms by 2030.

Additionally, government initiatives, such as the U.S. Meat Export Federation’s efforts to enhance international trade and regulatory frameworks supporting meat quality standards, are expanding market opportunities in both developed and emerging economies. Investments in research to improve processing techniques and develop plant-based analogs incorporating meat concentrates also offer avenues for diversification.

Governments worldwide continue to back sustainable meat production through grants and subsidies aimed at minimizing environmental impact, such as the U.S. Department of Agriculture’s Sustainable Agriculture Research and Education (SARE) program, which allocated over US$30 million in 2023 for advancing sustainable meat processing methods. These initiatives, coupled with growing demand in emerging markets due to rising middle-class populations, forecast a positive growth trajectory for the Meat Products Concentrates industry through 2030 and beyond.

Key Takeaways

- Meat Products Market size is expected to be worth around USD 107.5 Billion by 2034, from USD 48.9 Billion in 2024, growing at a CAGR of 8.2%.

- Poultry held a dominant market position, capturing more than a 43.1% share.

- Processed meat products held a dominant market position, capturing more than a 64.7% share.

- Hypermarket and supermarket channels held a dominant market position, capturing more than a 46.3% share.

- North America stands as the dominant region in the global meat products market, commanding a substantial 47.8% share, valued at approximately USD 23.3 billion

By Source

Poultry leads meat product sources with a 43.1% share in 2024, driven by its popularity and versatility.

In 2024, poultry held a dominant market position, capturing more than a 43.1% share of the meat products market by source. This strong presence is attributed to increasing consumer preference for leaner protein options, affordability, and wide availability. Poultry’s versatility in various cuisines and its faster production cycle compared to other meat sources further boosted its demand. As consumers continue to seek healthier and convenient protein alternatives, poultry’s market share is expected to maintain steady growth into 2025, supported by expanding production capabilities and evolving food trends favoring white meat.

By Product Type

Processed meat products lead with a strong 64.7% share in 2024, reflecting high consumer demand for convenience.

In 2024, processed meat products held a dominant market position, capturing more than a 64.7% share of the overall meat products market by product type. This significant share is driven by growing consumer preference for ready-to-eat and easy-to-prepare meat options that fit busy lifestyles. The convenience factor, combined with extended shelf life and variety in flavors, has made processed meats highly popular across different regions. As lifestyles continue to accelerate, demand for processed meat products is expected to remain robust in 2025, supported by ongoing innovations in packaging and preservation techniques that enhance product quality and safety.

By Distribution Channel

Hypermarkets and supermarkets lead with a 46.3% share in 2024, driven by convenience and product variety.

In 2024, hypermarket and supermarket channels held a dominant market position, capturing more than a 46.3% share in the meat products market by distribution. The preference for these retail formats stems from their ability to offer a wide range of products under one roof, competitive pricing, and convenient shopping experiences. Consumers increasingly favor hypermarkets and supermarkets due to their organized layout, availability of fresh and processed meat options, and attractive promotions. This trend is expected to continue growing in 2025 as these channels expand their reach, improve supply chain efficiency, and invest in enhancing customer experience.

![]()

![]()

Key Market Segments

By Source

- Poultry

- Beef

- Pork

- Mutton

- Sheep

- Goats

- Others

By Product Type

- Processed Meat Products

- Fresh Processed Meat

- Raw Cooked Meat

- Pre Cooked Meat

- Raw Fermented Sausages

- Cured Meat

- Dried Meat

- Cultured Meat Products

- Plant-based Meat

- Chilled

- Frozen

- Canned/Preserved

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Drivers

Rising Consumer Demand for Protein-Rich Diets Fuels Growth in Meat Products Market

One of the major driving factors behind the growth of the meat products market is the increasing consumer preference for protein-rich diets. In recent years, awareness about the health benefits of protein intake has surged, prompting more people to include meat products as a key part of their daily nutrition. According to the United States Department of Agriculture (USDA), the average per capita meat consumption in the U.S. reached approximately 222 pounds in 2023, marking a steady rise compared to previous years. This increase reflects a growing trend towards high-protein diets that support muscle development, weight management, and overall wellness.

Governments worldwide are also supporting this trend through nutrition education programs that encourage balanced diets, which include adequate amounts of protein. For example, the U.S. Department of Health and Human Services highlights the importance of protein in its Dietary Guidelines for Americans 2020-2025, recommending lean meat and poultry as key protein sources for healthy eating patterns. Similarly, many countries in Europe and Asia have launched public health campaigns to raise awareness of the benefits of protein consumption, which indirectly stimulates demand for various meat products.

Beyond health, lifestyle changes such as urbanization and increasing disposable incomes have boosted consumer purchasing power, especially in developing economies. As consumers seek convenient and nutritious food options, processed and ready-to-eat meat products have gained popularity, further propelling market growth. The Food and Agriculture Organization (FAO) reported a global increase in meat production reaching over 337 million tonnes in 2023, supporting growing demand.

Restraints

Health Concerns and Growing Shift Towards Plant-Based Alternatives Challenge Meat Products Market

A significant restraining factor limiting the growth of the meat products market is the increasing health concerns among consumers and the rising popularity of plant-based protein alternatives. Many people today are becoming more aware of the potential negative health effects linked to excessive consumption of red and processed meats, such as heart disease, obesity, and certain types of cancer. According to the World Health Organization (WHO), processed meat consumption has been classified as carcinogenic to humans, which has led many consumers to reconsider their dietary choices.

In line with this, there has been a notable rise in demand for plant-based and alternative protein products. Data from the Food and Agriculture Organization (FAO) shows that global consumption of plant-based proteins has grown steadily, as consumers seek healthier and more sustainable food options. This shift is particularly prominent among younger generations, who tend to prioritize health, environmental sustainability, and animal welfare in their purchasing decisions.

Governments and health organizations in various countries are also promoting dietary guidelines that emphasize reduced meat intake. For instance, the UK’s National Health Service (NHS) encourages citizens to limit red and processed meat consumption to lower health risks and improve overall well-being. Such guidelines influence public perception and behavior, indirectly restraining meat product consumption.

Opportunity

Expansion of Processed and Ready-to-Eat Meat Products Drives Market Growth

One of the major growth opportunities in the meat products market lies in the expanding demand for processed and ready-to-eat meat products. With busy lifestyles and changing consumer habits, there is a growing preference for convenient, easy-to-prepare protein options. According to the Food and Agriculture Organization (FAO), global meat consumption is expected to rise steadily, with processed meat products accounting for a significant portion of this increase, especially in urban areas where time-saving foods are in high demand.

Governments worldwide are supporting this trend by promoting food safety and quality standards for processed meat products. For instance, the U.S. Food and Drug Administration (FDA) continues to strengthen regulations around processing, packaging, and labeling, ensuring consumer confidence and encouraging industry growth. Additionally, initiatives like the European Union’s Food Safety Policy aim to harmonize safety measures across member countries, fostering market stability and expansion opportunities.

Technological advancements in preservation methods, such as high-pressure processing and vacuum packaging, are also boosting the shelf life and safety of ready-to-eat meat products. These innovations cater to consumer demands for fresh-tasting, nutritious, and safe food, further driving market penetration.

Trends

Plant-Based Meat Alternatives Gain Momentum in 2024

In 2024, the meat products market witnessed a notable shift towards plant-based meat alternatives, driven by growing consumer awareness of health and environmental concerns. This trend is supported by various global initiatives and projections from reputable organizations.

According to the Food and Agriculture Organization (FAO), global meat production is forecasted to increase moderately in 2024, driven by higher slaughter rates and favorable profit margins. However, this growth is accompanied by a rising demand for plant-based alternatives, reflecting a diversification in consumer preferences.

The United Nations’ Food and Agriculture Organization (FAO) has highlighted the environmental benefits of plant-based diets, noting that reducing meat consumption can significantly lower greenhouse gas emissions and conserve natural resources. This aligns with the FAO’s long-term projections, which indicate a 14% increase in global consumption of meat proteins by 2030 compared to the 2018–2020 average.

In response to these trends, governments are implementing policies to promote plant-based foods. For instance, Denmark’s Action Plan for Plant-based Foods outlines strategies to increase the availability and consumption of plant-based products, aiming to reduce the environmental impact of food systems.

Regional Analysis

North America stands as the dominant region in the global meat products market, commanding a substantial 47.8% share, valued at approximately USD 23.3 billion. The United States, in particular, plays a pivotal role, accounting for about 65% of the North American butchery and meat processing market, driven by high per capita meat consumption and a robust processing infrastructure .

The beef segment dominated the North American processed meat industry with the largest revenue share of 36.3% in 2024. Beef, being a high-quality protein source rich in essential minerals such as iron, zinc, and B vitamins, has become a popular choice among health-conscious consumers. Additionally, the popularity of high-protein diets and fitness trends has further boosted the demand for beef.

The poultry segment is expected to grow at the highest CAGR over the forecast period. The segment’s growth is attributed to the increasing consumer demand for protein-rich diets, advancements in poultry farming techniques, and the rising popularity of convenient and ready-to-cook poultry products. Additionally, expanding distribution channels and the growing awareness of the health benefits associated with poultry consumption have further contributed to the segment’s robust growth.

Government support and advancements in production technology also contribute to North America’s processed meat industry growth. For instance, the U.S. Department of Agriculture has invested in expanding poultry and meat processing capacity, which will bring new entrants and small processing facilities.

![]()

![]()

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Associated British Foods plc is a global diversified food company involved in meat products through its subsidiary operations. It focuses on high-quality processed meat and specialty foods, serving various international markets. The company emphasizes sustainability and innovation in its meat processing practices. With a strong presence in Europe and expanding operations worldwide, it continues to invest in modern processing facilities and product development to meet evolving consumer demands for healthier and convenient meat options.

Boar’s Head Provisions Co, Inc. is a leading producer of premium deli meats, cheeses, and condiments. Known for its commitment to quality and clean-label products, it caters primarily to the U.S. retail and foodservice sectors. The company emphasizes natural ingredients and offers a wide range of specialty meats without artificial additives. Its focus on product innovation and brand loyalty has solidified its position as a trusted name in the meat products market.

Cargill is a major player in the global meat products market, specializing in meat processing, animal nutrition, and food ingredient solutions. The company supplies a wide array of beef, pork, and poultry products worldwide. Cargill invests heavily in sustainable agriculture and responsible sourcing practices. Its integrated supply chain and technological advancements enable efficient production and distribution, positioning it as a vital contributor to the global meat industry.

Top Key Players in the Market

- Associated British Foods plc

- Boar’s Head Provisions Co, Inc.

- Cargill

- Conagra Foods, Inc.

- Danish Crown Vej

- Hormel Foods Corporation

- JBS SA

- Koch Foods, LLC.

- Maple Leaf Foods

- Marfrig Global Foods S.A.

- Minerva Foods SA

- OSI Group, LLC

- Perdue Farms, Inc.

- Sigma Alimentos, S.A. de C.V.

- Smithfield Foods, Inc.

Recent Developments

In 2024 Cargill, the company reported $160 billion in revenue, a nearly 10% decline from the previous year, primarily due to challenges in the beef and crop sectors .

In 2024 Conagra Brands Inc., the company reported net sales of approximately $12 billion, with its Refrigerated & Frozen segment generating $4.87 billion, a 5.6% decline from the previous year. This decrease was attributed to a 41% drop in volume and a 1.5% decline in price/mix, reflecting challenges in consumer demand and cost pressures .