Report Overview

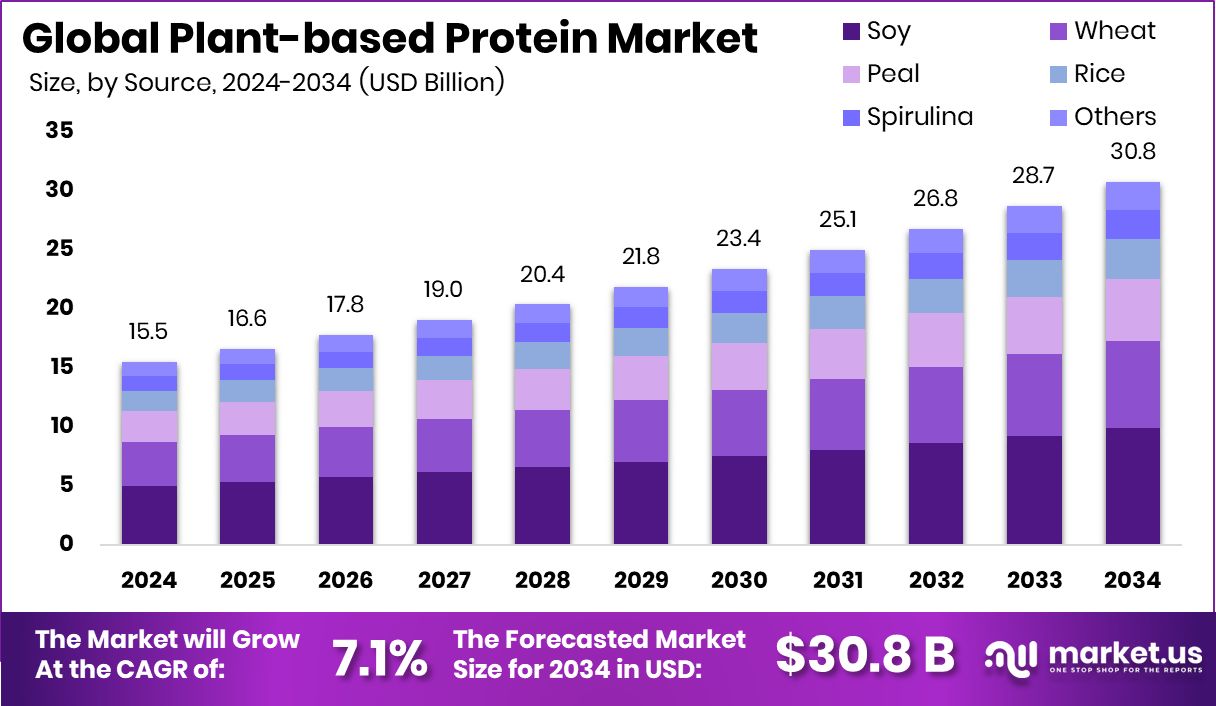

Global Plant-based Protein Market is expected to be worth around USD 30.8 billion by 2034, up from USD 15.5 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034. North America’s 46.3% share shows a strong consumer shift toward plant-based protein products.

Plant-based protein refers to protein sourced from plants such as peas, soybeans, lentils, chickpeas, quinoa, and brown rice. These proteins are considered cleaner and more sustainable alternatives to animal-based proteins. They contain essential amino acids, are often easier to digest, and have lower saturated fat content. Plant-based protein is widely used in food products like meat substitutes, dairy alternatives, protein powders, and snacks.

![]()

The plant-based protein market includes the production, processing, and sale of protein ingredients and end-products made entirely from plants. This market has expanded beyond traditional vegetarian foods and now includes a wide range of innovative applications such as plant-based burgers, dairy-free yogurts, protein bars, and meal replacements.

One of the biggest growth drivers is the rising health consciousness among consumers. Many people are moving away from red meat and processed foods, leading to increased interest in plant-derived nutrition. Research continues to link high intake of plant proteins with reduced risk of cardiovascular disease, obesity, and type 2 diabetes, pushing more consumers toward plant-based choices.

According to an industry report, the UK government is investing £15 million (€17.8 million) to establish a new alternative protein hub focused on plant-based, fermentation-made, and cultivated foods. Evolved Foods, a leading plant-based protein company, has successfully closed its seed funding round, raising Rs 7.30 crore.

In the 2024 budget, the German government has allocated €38 million to support precision-fermented, plant-based, and cultivated meat and dairy alternatives. Plantible, a developer of duckweed-based protein, has raised $30 million to expand operations in response to growing demand for functional ingredients.

Key Takeaways

- Global Plant-based Protein Market is expected to be worth around USD 30.8 billion by 2034, up from USD 15.5 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034.

- In the Plant-based Protein Market, soy accounted for a 32.2% share due to its protein-rich profile.

- Isolates held the largest share at 48.4%, widely used in protein powders and fortified beverages.

- Conventional sources dominated with an 82.3% share, driven by established farming and lower production costs.

- Functional foods captured a 35.7% share, as health-conscious consumers prefer nutrition-packed meals and snacks.

- Plant-based protein demand surged in North America, reaching USD 7.1 billion in value.

By Source Analysis

In the Plant-based Protein Market, soy accounted for 32.2% of the source share.

In 2024, Soy held a dominant market position in the By Source segment of the Plant-based Protein Market, with a 32.2% share. This leading share is primarily driven by soy’s strong nutritional profile, including complete amino acid content and high digestibility, which makes it a preferred choice for manufacturers of plant-based protein products.

Its widespread availability and compatibility with various food formulations, such as protein bars, meat analogs, and beverages, have further supported its leading position in the market. The demand for soy-based protein has remained consistent across functional foods, supplements, and dietary regimes due to its versatility and consumer familiarity.

Moreover, soy is a cost-effective option compared to many other plant sources, making it commercially attractive in regions where price sensitivity plays a key role in product adoption. Its dominance also reflects long-standing usage in vegetarian and vegan diets globally, especially in countries with established soy processing infrastructure.

By Form Analysis

Isolates dominated by form in the Plant-based Protein Market with a 48.4% share.

In 2024, Isolates held a dominant market position in the By Form segment of the Plant-based Protein Market, with a 48.4% share. This leadership is attributed to their high protein concentration, typically above 90%, making them ideal for protein-fortified food and beverage formulations.

Their neutral taste, easy digestibility, and excellent solubility have made isolates especially popular among health-conscious consumers, athletes, and food manufacturers. The dominance of isolates is also supported by their growing adoption in functional foods, where clean-label and high-protein trends are driving demand.

Food processors prefer isolates due to their compatibility with diverse applications such as protein shakes, bars, dairy alternatives, and meal replacements. Their ability to mimic animal-based protein functionality further strengthens their role in the plant-based product landscape. As plant-based diets gain wider acceptance across mainstream consumers, isolates have remained the preferred choice because they deliver concentrated nutrition with minimal carbs and fats.

The convenience of processing isolates into ready-to-mix or ready-to-drink formats has also influenced their growing usage in retail health supplements. With half the market leaning toward isolates, manufacturers continue to focus on enhancing extraction technologies and refining protein purity to cater to evolving dietary needs.

By Nature Analysis

Conventional plant-based proteins held an 82.3% share by nature in 2024.

In 2024, Conventional held a dominant market position in the By Nature segment of the Plant-based Protein Market, with an 82.3% share. This overwhelming majority is primarily driven by its widespread availability, lower cost, and established supply chain infrastructure.

Conventional plant-based protein sources such as soy, peas, and wheat are cultivated at a large scale across multiple regions, allowing for consistent sourcing and competitive pricing. These factors have made conventional variants the preferred choice among manufacturers targeting mass-market food and beverage applications.

The 82.3% share reflects strong consumer acceptance for conventional plant-based protein across everyday products like meat alternatives, protein powders, and dairy-free beverages. Unlike organic alternatives, conventional variants benefit from faster production cycles and fewer regulatory constraints, making them more commercially viable. Additionally, their versatility in formulation and stability in large-scale processing have made them a go-to ingredient in functional foods and health supplements.

While demand for organic protein is rising in niche segments, the mainstream market continues to favor conventional options due to affordability and familiarity. This dominance is expected to persist as global demand for cost-effective, protein-rich diets continues to grow, especially in emerging economies.

By Application Analysis

Functional foods led by application with 35.7% in the Plant-based Protein Market.

In 2024, Functional Foods held a dominant market position in the By Application segment of the Plant-based Protein Market, with a 35.7% share. This dominance reflects the growing consumer shift toward nutrition-focused eating habits, where foods are expected to deliver both taste and health benefits. Functional foods enriched with plant-based protein, such as protein bars, meal replacement drinks, and dairy alternatives, have gained popularity due to their ability to support muscle health, weight management, and overall wellness.

The 35.7% share underscores the increasing role of plant-based protein in enhancing the nutritional profile of daily food products. Functional foods are appealing to a broad demographic, including fitness enthusiasts, older adults, and consumers seeking plant-forward diets. Manufacturers are integrating isolates and other protein-rich ingredients into snacks and beverages to meet rising demand for high-protein, clean-label products. Additionally, functional foods offer a convenient format, aligning with on-the-go lifestyles and busy schedules.

The dominance of this segment is also reinforced by widespread retail availability and product innovation, helping drive broader adoption. As health-conscious eating continues to influence purchasing behavior, functional foods with plant-based protein are likely to maintain their leadership.

![]()

![]()

Key Market Segments

By Source

- Soy

- Wheat

- Peal

- Rice

- Spirulina

- Others

By Form

- Isolates

- Concentrates

- Hydrolysates

By Nature

By Application

- Functional Foods

- Snacks and Cereals

- Dairy Alternatives

- Bakery and Confectionery

- Animal Feed

- Sports Nutrition

- Others

Driving Factors

Rising Health Awareness Boosting Protein-Rich Diets Globally

People around the world are becoming more health-conscious and are choosing food that supports wellness. Plant-based proteins are gaining popularity because they are seen as healthier alternatives to meat and dairy. These proteins are naturally low in cholesterol and fats, and they help support heart health and muscle strength. Consumers are now reading labels and looking for clean, high-protein foods.

As a result, more people are adding plant-based protein into their meals daily, from shakes to snacks. This shift is especially strong among fitness enthusiasts, older adults, and those managing weight or chronic health issues. As health awareness grows, so does the demand for plant-based protein, making it a key driver in the market’s growth.

Restraining Factors

High Production Costs Limit Wider Market Reach

One of the biggest challenges for the plant-based protein market is the high cost of production. Extracting protein from plant sources like peas or soy requires advanced technology and energy, which adds to manufacturing expenses. These costs are often passed on to consumers, making plant-based protein products more expensive than traditional animal-based options.

In many regions, especially in developing countries, people still choose cheaper protein sources due to budget constraints. This price gap can slow down adoption and limit demand. Until production becomes more efficient and cost-effective, plant-based protein may struggle to reach price-sensitive consumers, holding back its growth in some markets despite the rising interest in healthier food options.

Growth Opportunity

Expanding Demand From Fitness And Sports Nutrition

The rising interest in fitness and active lifestyles is creating a big opportunity for plant-based protein. More athletes, gym-goers, and health-conscious people are choosing plant proteins for muscle recovery, strength, and energy. These proteins are easy to digest and rich in nutrients, making them perfect for shakes, protein bars, and supplements.

Plant-based options are also ideal for people avoiding dairy or meat. As fitness trends grow worldwide, especially among young adults, demand for plant protein in sports nutrition is expected to rise sharply.

This opens the door for new product launches, especially in powders, drinks, and ready-to-eat formats focused on performance and health. The sports nutrition segment offers long-term growth for plant-based protein brands.

Latest Trends

Expanding Demand From Fitness And Sports Nutrition

The rising interest in fitness and active lifestyles is creating a big opportunity for plant-based protein. More athletes, gym-goers, and health-conscious people are choosing plant proteins for muscle recovery, strength, and energy. These proteins are easy to digest and rich in nutrients, making them perfect for shakes, protein bars, and supplements.

Plant-based options are also ideal for people avoiding dairy or meat. As fitness trends grow worldwide, especially among young adults, demand for plant protein in sports nutrition is expected to rise sharply.

This opens the door for new product launches, especially in powders, drinks, and ready-to-eat formats focused on performance and health. The sports nutrition segment offers long-term growth for plant-based protein brands.

Regional Analysis

In 2024, North America led with a 46.3% share, totaling USD 7.1 billion.

In 2024, North America held a dominant position in the Plant-based Protein Market, accounting for 46.3% of the global share and generating USD 7.1 billion in revenue. This leadership is attributed to increased health consciousness, dietary shifts toward vegan and flexitarian lifestyles, and growing product availability in both retail and foodservice channels.

In Europe, the market showed steady uptake due to rising demand for sustainable protein sources and consumer inclination toward clean-label products. The Asia Pacific region experienced notable interest in plant-based protein driven by urbanization and evolving food habits across countries like India, China, and Japan.

Meanwhile, Latin America and the Middle East & Africa regions are gradually adopting plant-based proteins, though market penetration remains limited compared to developed regions. Growth in these areas is primarily fueled by awareness campaigns and increasing exposure to global dietary trends. While all regions contribute to the expansion of the plant-based protein market, North America’s significant 46.3% share firmly establishes it as the leading regional market.

Continued investments in product innovation and expansion of plant-based offerings across North American supermarkets and online platforms further reinforce its market leadership. The region is expected to maintain its dominance as consumer preference steadily moves toward healthier, plant-centric diets.

![]()

![]()

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, AGT Food and Ingredients maintained a strong position in the global plant-based protein market due to its large-scale pulse processing operations and supply of high-quality protein ingredients. With its focus on lentils, peas, and chickpeas, the company remained a key source of plant proteins for food manufacturers globally. AGT’s vertically integrated model—from farm to ingredient—ensured quality, traceability, and consistent supply, positioning it as a reliable partner in the rapidly growing demand for plant-based foods.

PURIS continued to expand its footprint in the U.S. and international markets with its non-GMO pea protein range. The company benefited from rising interest in sustainable proteins, and its close collaboration with farmers helped ensure seed innovation and transparency across the supply chain. In 2024, PURIS further emphasized clean-label and allergen-free products, making its protein ideal for use in meat alternatives, beverages, and nutritional supplements.

Kerry Group PLC leveraged its strong R&D capabilities and global distribution network to offer customized plant-based protein solutions. With a diverse portfolio spanning soy, pea, and rice proteins, Kerry Group remained a key ingredient supplier to major food and beverage brands. In 2024, the company focused on enhancing taste, texture, and nutritional value in plant-based applications, helping clients meet evolving consumer expectations.

Top Key Players in the Market

- Tate & Lyle PLC

- ADM

- Ingredion

- Glanbia plc

- AGT Food and Ingredients

- PURIS

- Kerry Group PLC

- Cargill Incorporated

- Roquette Frères

- Burcon NutraScience Corporation

- COSUCRA

- DSM Firmenich

- International Flavors & Fragrances Inc.

- Wilmar International Ltd.

- Emsland Group

Recent Developments

- In October 2024, Tate & Lyle inaugurated a new automated laboratory in Singapore dedicated to mouthfeel solutions. This facility employs advanced robotics to accelerate the development of plant-based food products with improved textures, supporting the company’s commitment to innovation in plant-based protein applications.

- In March 2023, ADM partnered with Marel to open an innovation center in the Netherlands. This facility focuses on developing next-generation, protein-forward foods, supporting the advancement of alternative protein solutions from concept to commercialization.