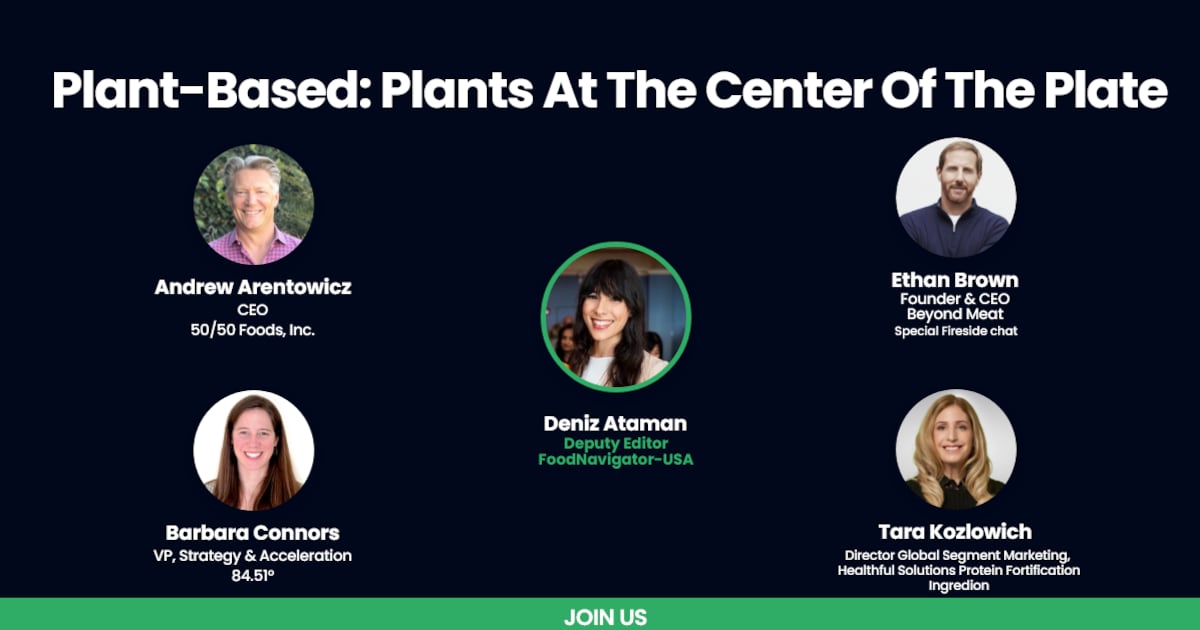

Innovation in the plant-based space is shifting from novelty to purpose, as experts emphasized the role of targeted formulation, branding and communication in building consumer trust, during FoodNavigator’s Plants at the Center of the Plate broadcast.

Retail data from 84.51°, the marketing insights arm of Kroger, shows the plant-based category is at a turning point. After a sharp rise in consumer adoption between 2019 and 2021, sales have since plateaued – and in some segments, declined, according to Barbara Connors, VP of strategy and acceleration at 84.51°. However, growth remains in specific areas like plant-based soft cheese, meatless entrées and egg alternatives.

Consumer behavior is being shaped by four macro trends: a need for meal simplification, a desire to elevate food’s role in personal wellness, shifting family dynamics and a demand for ease and personalization, per the report.

“Customers are really looking to simplify their meals,” noted Connors. “They are also expanding their definition of wellness and seeking out new flavors.”

Connors added that despite the perception of a “hype cycle,” protein is still top of mind in snacks. However, taste remains paramount.

She also highlighted a growing interest in ingredients that double as both staples and inputs.

“The pops that over the last year we have seen growth in are plant-based egg replacement and plant-based cheese,” which can be foods or ingredients in recipes, she said.

At the same time, broader economic forces are reshaping shopping habits. Rising prices, declining consumer sentiment, and what Connors called a climate of “radical uncertainty” – from health to economic outlook – have increased shoppers’ price sensitivity. These factors are driving shifts in where, what and how consumers buy, including smaller baskets, more frequent trips, an emphasis on private label and a resurgence in food-at-home over eating out, she explained.

Identifying increasers and decliners

Within the plant-based category, 84.51° identifies two key shopper segments: Increasers and decliners.

- Increasers, or those consuming more plant-based foods, are primarily motivated by health and environmental benefits. But cost remains a barrier. “Even among our most engaged shoppers, two-thirds say they’d buy more if there were more coupons and promotions,” Connors said. They also want support – more recipes, more education and more inspiration.

- Decliners cite taste and texture as the primary reasons they are pulling back on plant-based foods, although dissatisfaction with flavor has softened over time. “Each year, taste remains the number one reason for decline – but it is trending downward, which is a positive sign for the category,” she said. Price concerns are also rising, mirroring broader market trends.

A shift toward “fit-for-purpose” protein

Brands today are seeking out beyond just protein for their products, explained Tara Kozlowich, director of global segment marketing and healthful solutions of protein fortification at Ingredion during the panel.

“Brands are no longer looking for any protein. They are looking for the right protein for that specific application, their label and their consumer.”

She continued: “In sports nutrition, consumers are really wanting beverages with that clean taste, no grit, no sedimentation or separation.”

Ingredion’s pea protein ingredient Vitessence Pea 100 HD, for example, “is specifically designed to be optimized for nutritional beverages” with improved solubility and viscosity that offers a clean, neutral taste, Kozlowich added.

She also highlighted demand in bars, where consumers are seeking “higher protein content” without the “dry, gritty mouthfeel.” Ingredion’s Vitessence helps formulators “hit those protein targets without getting that dry, gritty mouthfeel that used to be a very common challenge.”

Kozlowich emphasized that to succeed, plant proteins must deliver “that functionality and the sensory.”

Watch Plants at the Center of the Plate on demand

Demand for plant-based has held strong, despite a “correction” in meat analog performance, with many consumers increasingly seeking products that prominently feature fruits, vegetables, legumes and grains that do not masquerade as “alternatives” to animal-based products. We explore how plant-based is evolving, including the emergence of products that combine animal- and plant-based ingredients, and what tools are available to formulators – including emerging ingredients, manufacturing techniques and modern marketing lingo.

This broadcast is free to watch anytime. Click here to regist er for free.

Blended burgers offer a pragmatic path to meat reduction

As more consumers aim to reduce their meat intake without eliminating it entirely, blended burgers (a combination of meat and plant-based ingredients) are emerging as a potentially practical, flavor-forward solution.

Rather than mimicking meat, products like the burger from 50/50 Foods build on its strengths – combining real beef with roasted mushrooms, caramelized onions and garlic for a savory, umami-rich bite, according to Andrew Arentowicz, CEO of 50/50 Foods.

Arentowicz believes the early plant-based movement identified the right consumer problem of reducing meat consumption but offered the wrong solution.

“I had a hunch that Impossible and Beyond were going to overpromise and underdeliver,” he said. “The market identified the right problem,” but “the market picked the wrong solution,” Arentowicz added.

Blended formats may hold more appeal for flexitarians who want to make better choices without giving up the taste and texture of conventional meat, Arentowicz explained. Yet, despite the straightforward formulation, communicating the value of a blended product is not always easy.

“As simple as the idea is, it is still a radically new idea in the marketplace,” said Arentowicz. “We need to spend a lot more time, energy [and] resources on educating the consumer on what this is.”

Clean label and ingredient transparency play a central role in building that trust. “We have got an extremely clean ingredient profile,” he noted. “It is basically six ingredients with some seasoning – no additives, no binders, no nothing.”

On regulatory classification and language limitations

Because 50/50’s product contains real beef, it falls under USDA jurisdiction, which has stricter standards and narrower definitions than the FDA, Arentowicz explained.

“We cannot use the word ‘plant-based’ anywhere on our packaging,” Arentowicz said. “The USDA has a standard of identity for what a beef burger is, and you are not allowed to use language that modifies it.”

He framed this as both a challenge and an opportunity, since it prevents misleading claims and emphasizes clarity.

“It forces us to be really clear and transparent. And with a clean label and simple ingredients, we are proud to lean into that,” he added.

He sees USDA oversight as a potential benefit in a climate of consumer skepticism toward overly processed alternative proteins.

“The FDA gives you a lot of flexibility in how you describe your product, which is great for innovation but can erode trust when it is not used responsibly,” he said. “USDA oversight is stricter, but in some ways, that is what consumers are asking for right now – clarity and honesty,” Arentowicz explained.

Arentowicz also pointed out that regulatory complexity mirrors the consumer confusion in the aisle – especially as blended products do not neatly fit in “meat” or “plant-based” categories.

“There is still no real home for us in the store,” he said. “We are trying to help meat-eaters reduce, but we do not belong next to the veggie burgers, and we are not a traditional beef product either. That gray area is part of the opportunity.”

Language matters – but so does simplicity

When it comes to product naming and consumer understanding, Arentowicz acknowledged the challenge.

“The word ‘blended’ should not be around the word meat,” and instead verbiage like “balanced protein,” could offer a more realistic description of these types of products, he explained.

While consumers may still be unfamiliar with terms like “flexitarian,” he noted, “I think the word ‘flexitarianism’ is starting to become more powerful.”

Connors agreed, adding that “the flexitarian group is one that is growing” because “it does not have emotional baggage with it. It is a little bit more descriptive of what it is.”