Textured Vegetable Proteins, primarily used in meat substitutes, have become popular across B2B and B2C segments, owing to their versatility and high protein content. The report, featuring insights into global tariff developments, offers a detailed analysis of market trends, projections, and regional growth, with key insights into major players and competitive dynamics.

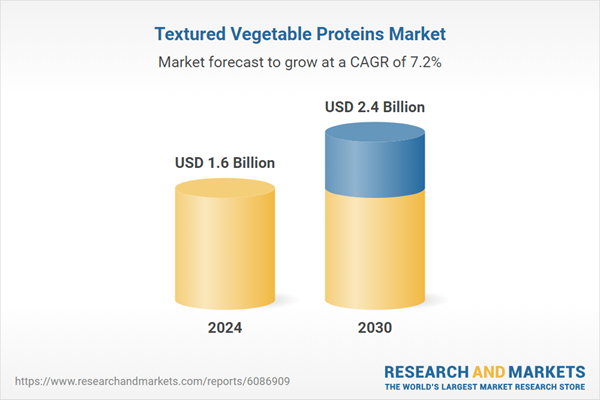

Textured Vegetable Proteins Market

Dublin, June 05, 2025 (GLOBE NEWSWIRE) — The “Textured Vegetable Proteins – Global Strategic Business Report” has been added to ResearchAndMarkets.com’s offering.

The global market for Textured Vegetable Proteins was valued at US$1.6 Billion in 2024 and is projected to reach US$2.4 Billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030.

This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Textured Vegetable Proteins market.

What Is Fueling the Surge in Demand for Plant-Based Protein Alternatives?

Textured Vegetable Proteins (TVP), also known as textured soy protein or soy meat, are defatted soy flour products that replicate the texture of meat. Their versatility, affordability, and nutritional profile have positioned them as a leading meat substitute across various global markets. The rising inclination towards plant-based diets due to health, environmental, and ethical concerns has drastically amplified the consumption of TVPs. These proteins offer high protein content, low fat levels, and zero cholesterol – making them appealing for consumers seeking healthier lifestyles without compromising taste or mouthfeel. Furthermore, an increase in lactose intolerance, veganism, and flexitarian diets globally has significantly influenced purchasing behavior, turning TVP into a staple in not just households, but also in institutional and commercial food applications.

One major catalyst for the demand spike has been the hospitality and foodservice industry’s shift towards inclusive menus. Hotels, quick-service restaurants, and cafes have expanded their offerings to include meat analogs made with TVPs. This is further reinforced by aggressive marketing campaigns by major food brands, endorsements from celebrities, and growing social media influence around sustainability and health.

Moreover, clean-label preferences and transparency in sourcing have led consumers to scrutinize ingredient lists, where TVPs score highly due to their minimally processed nature and recognizable origins from soy, wheat, or pea sources. The dual impact of health awareness and inclusivity in food habits is reshaping the protein consumption landscape at a foundational level.

Are Advancements in Food Technology Reshaping TVP Applications?

Innovation in extrusion technology – the cornerstone of TVP production – has allowed manufacturers to create products with increasingly sophisticated textures, mimicking everything from ground beef to pulled pork and even fish fillets. The evolution of high-moisture extrusion cooking (HMEC) has brought forth a new class of premium textured proteins that offer a juicier, more fibrous bite, opening new frontiers in gastronomy and processed foods. Moreover, ingredient diversification beyond soy – such as pea, wheat, lentil, and fava bean-based TVPs – has enhanced allergen management and expanded the market to include previously restricted consumer groups. This technological progress has not only improved the organoleptic qualities of TVPs but also addressed the taste fatigue that early adopters often reported.

Another leap has been in shelf-life and packaging innovations. Modified atmosphere packaging (MAP) and vacuum-sealed formats now enable TVPs to be distributed more widely, reducing spoilage and ensuring consistency across geographies. Additionally, smart production techniques that integrate precision fermentation and AI-based flavor modulation are enabling hyper-customization of TVPs to meet local taste profiles and dietary norms. For instance, in Asian markets, TVPs are being tuned to mimic regional delicacies such as char siu or curry meats. These advanced applications have elevated TVP from a basic meat extender to a central component in gourmet plant-based meals, school lunch programs, and emergency rations.

How Are Global Consumer Patterns Influencing TVP Utilization?

Consumption behavior has rapidly evolved, with millennials and Gen Z exhibiting high acceptance of alternative proteins, primarily due to their alignment with climate activism, animal welfare, and wellness. These generational cohorts are not only early adopters but also advocates for change, prompting retailers and manufacturers to adapt quickly. Private label penetration into the textured vegetable protein space has also witnessed considerable expansion, especially in Europe and North America, making the product more accessible through affordable store-brand options. The rise of e-commerce platforms offering customizable plant-based bundles, subscription boxes, and ready-to-cook meals further amplifies consumer exposure and trial.

In developing economies, affordability and accessibility have been the main levers of TVP growth. Countries in Africa and South Asia are incorporating TVPs into humanitarian food aid programs and public health nutrition strategies due to their long shelf life, nutritional density, and ease of transport. Meanwhile, in developed markets, TVPs are now found in everything from pet food to snacks, expanding beyond traditional meal formats.